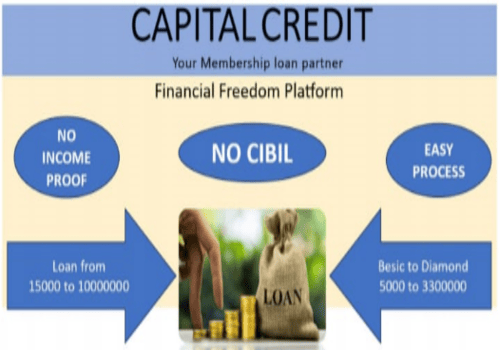

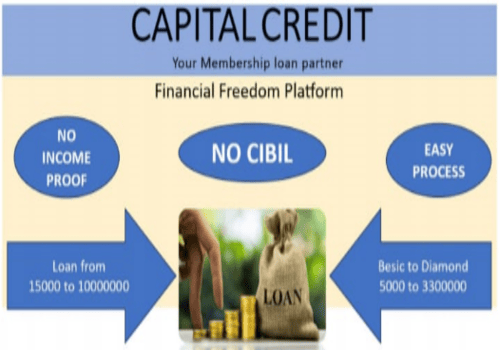

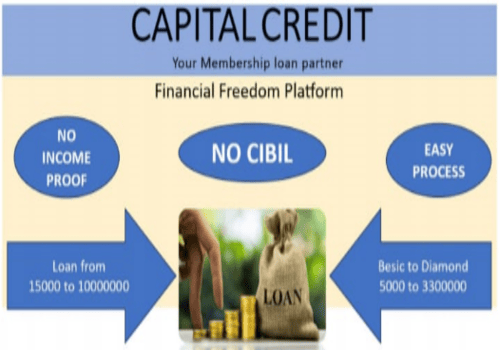

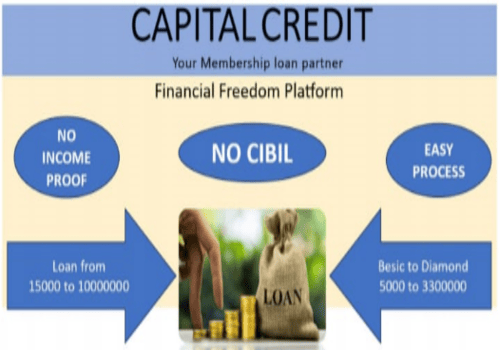

Welcome To Capital credit

Your Membership Loan Partner

No Cibil

Financial Freedom Plateform

No income proof and easy process

The different types of private equity investments obtain capital from various sources. These include affluent investors, pension funds, labour unions, insurance companies, universities endowments, and foundations.

Typically,the fund will be structured as a unit trust or limited partnership that raises capital from institutional and sophisticated investors.

Learn MoreYes,investors often have the option to reclaim their funds when investments go wrong and debts have not been paid.

Learn MoreA flexible fund is a mutual fund pooled investment that has broad flexibility for making investment decisions and allocations. We are provided a flexible fund.

Learn Morecustomers can get help and find answers to questions as soon as they come up—24/7 and in real-time.

Learn MoreA private investment fund is an investment company that does not solicit capital from retail investors or the general public. Members of a private investment company typically have deep knowledge of the industry as well as investments elsewhere.

We can save your money.

Production or trading of good

Our Capital credits is flexible

More Information

Capital credit-based financial services are only those that take care of funding or transactions of money and related activities. For example, banks and NBFCs offer long-term and short-term loans, overdrafts, or other cash transaction services to individuals and businesses based on their repayment power.

A hedge fund is a partnership of investors who pool their money with the aim of earning above-average returns.

Read More

Venture capital (VC) is a form of private equity and a type of financing for startup companies and small businesses with long-term growth potential.

Read More

The second type of private equity strategy is growth equity, which is capital investment in an established, growing company.

Read More

A private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by all the investors and uses.

Read More